Generative Artificial Intelligence (GAI) holds substantial importance within the banking sector, presenting a promising avenue for advancement. By incorporating generative AI into banking operations, financial institutions can streamline handling vast data, automate processes, and discern emerging trends. This integration brings forth significant advantages, enhancing the overall quality of services.

In this post, you’ll learn about real-world application of AI in banking, showcasing market instances that underscore its pivotal role, significance, and the numerous benefits it offers.

What Is Generative AI

Generative AI in banking refers to a specific branch of artificial intelligence that can generate information or content by drawing upon pre-existing data. Unlike alternative forms of artificial intelligence, which primarily operate on the principles of data learning, Generative AI retains the unique capability to generate fresh data, which can then be harnessed to formulate strategies and make predictions.

Finance and Banking use various programs and solutions that harness the potential of Artificial Intelligence (AI), including deep learning, neural networks, and genetic algorithms. These technologies are employed to analyze data, revealing concealed patterns and correlations. This distinct application of AI in Finance and Banking distinguishes it from other forms of artificial intelligence, as it scrutinizes and interprets data and can generate fresh insights. Nevertheless, these advantages became why thousands of business owners are questioned about how to create a banking app incorporating GAI.

The advantages of employing AI in the banking sector are unmistakable. Financial institutions can access precise and dependable predictions to assist them in formulating strategic decisions regarding investments, risk management, and lending. Furthermore, AI technology enables the thorough examination of customer data and the customization of tailored products and services, ultimately enhancing the customer experience and elevating their satisfaction with the bank.

Artificial Intelligence (AI) appears vital in banking, offering the capability to manage data efficiently, automate various processes, and forecast emerging trends. Its ability to generate fresh data and insights empowers financial institutions, granting them a competitive edge in their decision-making processes and enhancing the overall customer experience.

AI has witnessed a surge of inventive applications within the financial sector, encompassing cutting-edge technologies such as deep learning, neural networks, various algorithms, and more. Deep learning is a crucial innovation in AI-driven finance, facilitating the adept processing and intricate analysis of multifaceted data by neural networks. Fashioned after the human brain, these neural networks find utility in categorization, prediction, and even generating novel datasets. Genetic algorithms, on the other hand, play a crucial role in optimizing processes and uncovering optimal solutions by applying principles rooted in evolution.

Generative AI in Finance Benefits

One of the foremost benefits of GAI includes a notable enhancement in efficiency. Generative AI in the financial sector can swiftly and accurately handle substantial volumes of data, surpassing human capabilities. This prowess empowers artificial intelligence-driven banks to significantly expedite processing tasks such as loan applications and customer verification. Consequently, banks can elevate the quality of their customer service while concurrently optimizing their operational efficiency.

- Data analysis. Enabling financial institutions to delve into vast troves of data, encompassing historical customer records, financial markets data, and economic trends, facilitates comprehensive analysis. This in-depth examination empowers banks to uncover concealed patterns and interconnections, augmenting their capacity to arrive at well-founded decisions. Banks employ advanced algorithms to forecast trends and potential outcomes. An illustrative case is the application of Artificial General Intelligence (AGI), which aids banks in forecasting investment risks and returns. This predictive capability enhances their decision-making prowess, ultimately mitigating potential losses.

- Process automation. Financial institutions can employ General Artificial intelligence (GAIs) to automate repetitive operations, including but not limited to the processing of loan applications, the validation of financial data, and the authentication of documents. This implementation reduces processing duration, enhances customer service quality, and has a heightened ability to adapt to shifts within the market landscape promptly.

- Forecasting. Artificial intelligence in the financial sector empowers financial institutions to anticipate forthcoming market trends, forecast customers’ creditworthiness, and evaluate potential risks.

- The tasks that generative AI banking can solve include processing loan applications, assessing credit risk, and anti-fraud measures. The GAI system can autonomously assess loan requests, evaluate a client’s credit background, and forecast potential hazards. It aids various sectors in making well-informed lending decisions while mitigating the likelihood of non-payment. Furthermore, artificial intelligence in investment banking is proficient at pinpointing deceitful transactions through an in-depth analysis of transactional data, pinpointing irregularities or questionable trends.

Generative Artificial Intelligence (GAI) has discovered another successful application in marketing and advertising. GAI is proving exceptionally beneficial in the finance sector, particularly in its capacity to scrutinize consumer behavior data, predict their requirements, and create tailor-made advertising campaigns for financial institutions. Through its capabilities, GAI assists in revealing hidden patterns and emerging trends, empowering businesses to devise highly focused marketing strategies and elevate customer engagement.

Generative AI Use Cases In Banking

Artificial intelligence has become a primary force within the banking sector, revolutionizing financial institutions’ operations. Its capabilities empower banks to meticulously analyze vast datasets, streamline operational workflows, and forecast emerging trends. The applications of AI in banking are multifaceted, encompassing functions like expeditious loan application evaluations, meticulous risk assessments, and robust anti-fraud measures.

Incorporating AI technology results in heightened operational efficiency, expedited processing timelines, and elevated customer service quality levels. Notably, a growing number of global banks are progressively integrating generative artificial intelligence (GAI) into diverse facets of their operations. Let’s delve into some prominent instances of AI’s impact on the banking landscape:

- JPMorgan Chase, one of the United States’ foremost banking institutions, has embraced Generative Artificial Intelligence (GAI) across various applications. Their utilization of GAI extends to process automation, data analysis, risk projection, and anti-fraud measures. JPMorgan Chase actively dedicates resources to GAI research and development to enhance efficiency and customer experience.

- Citigroup, the globally renowned financial juggernaut, similarly integrates GAI into its operational framework. Citigroup harnesses the power of GAIs to enhance risk management processes, streamline operations through automation, and conduct in-depth data analysis. GAI is pivotal in optimizing Citigroup’s operational facets, enabling more precise, well-informed decision-making.

- HSBC, one of the world’s largest banking institutions, has fully embraced the potential of generative AI within finance. Their utilization of GAIs spans enhancing customer service, process automation, and advanced data analysis. GAI empowers HSBC to optimize its operational workflows, expedite processes, and deliver customers more personalized and precise services.

- Barclays, a prominent British bank, has also adopted GAI as an integral component of its operational toolkit. Barclays leverages GAI for data analysis, risk prediction, and anti-fraud measures. This strategic use of GAI equips Barclays to make more informed decisions and safeguard the interests of their valued clientele.

- UBS – a Swiss international bank, is actively researching and incorporating GAI into various aspects of its workflow. They use GAIs to analyze data, automate processes, and forecast markets. GAI helps the bank adapt to ever-changing client requirements.

AI Banking Market Statistics

Successful instances of applying financial artificial intelligence exemplify the active utilization of this technology. Here, we will present data affirming the burgeoning presence and utilization of AI in the banking sector:

- The global market for artificial intelligence in banking is anticipated to attain a valuation of $41.1 billion by 2026, experiencing a CAGR (compound annual growth rate) of 31.2%, spanning from 2021 to 2026.

- 77% of major financial institutions have taken proactive steps to integrate artificial intelligence into their overarching business strategies, including Generative Intelligence and Insight (GII).

- A recent survey indicates that 75% of banks foresee GII making significant inroads into their operational frameworks within three years.

- Data and document processing operations within financial software have emerged as the most sought-after domains for generative AI. Over 60% of banks are deploying GIIs to streamline and automate data processing tasks.

- Risk assessment constitutes yet another critical arena where GIIs find substantial applications within the banking industry. Roughly 40% of banks leverage GIIs to anticipate and evaluate risks, enabling them to render more well-informed lending and investment decisions.

- Experts speculate that the utilization of GIIs can reduce the processing time for loan applications by a noteworthy 50% while enhancing the precision of risk projections by 25%.

The data presented in these statistics unequivocally demonstrate the escalating significance and utilization of generative artificial intelligence within the banking sector. Financial institutions proactively embrace GAI to enhance operational efficiency, augment predictive precision, and expedite transaction processing.

This empowers them to render insightful judgments, deliver exact customer assistance, and function with heightened security and operational effectiveness. To become one of the successful market illustrations, it is vital to apply to a credible banking software development company and find a vendor with extensive experience in this domain.

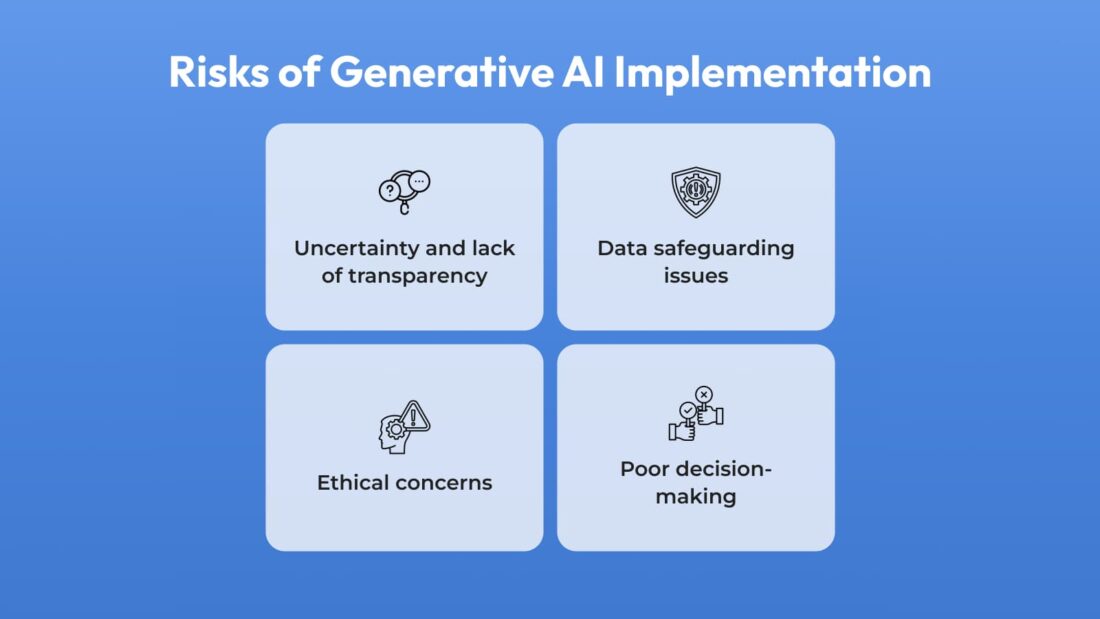

Finance Artificial Intelligence Risks And Challenges

One of the key issues associated with General Artificial Intelligence (GAI) pertains to the lack of transparency and the ability to clarify the decisions made by the system. An Intelligent Information Processing (IIP) system functions using complex algorithms and models, which are frequently difficult to comprehend and express.

Financial institutions must commit to developing and deploying GAIs, prioritizing transparency and explainability, and allowing customers and regulatory bodies to gain insight into these decisions’ determinants.

Another concern linked to General Artificial Intelligence (GAI) revolves around data security and safeguarding privacy. The inadvertent exposure or mishandling of data can severely harm a bank’s standing and compromise customer confidence.

It is imperative for banks to proactively allocate resources towards bolstering their cybersecurity infrastructure and crafting stringent protocols and countermeasures to ensure the impervious protection of customer data against potential threats. AI for KYC automation is another ability that is truly valuable for banks. Even though GAIs demonstrate remarkable capabilities, they remain dependent on algorithms and models that can be susceptible to inaccuracies or partiality.

Banking institutions must diligently scrutinize and guarantee the integrity of the data employed in training GAIs and consistently validate the accuracy and dependability of the system’s decision-making processes. Additionally, implementing feedback mechanisms and error rectification protocols is paramount to address conceivable issues and progressively enhance the system’s performance.

Ethical concerns about implementing General Artificial Intelligence (GAI) within the banking sector deserve utmost attention. Financial institutions must exercise great caution when employing GAI in pivotal decision-making procedures that could substantially affect individuals, such as loan approvals or risk evaluations.

Banks must uphold the core values of fairness, equality, and non-discrimination during the development and utilization of GAI systems. Additionally, maintaining transparency and providing comprehensible explanations for decisions is vital, ensuring that customers comprehend the decision-making process and have avenues for recourse when necessary.

Summing Up

Overall, the importance of generative AI in the banking industry should not be underestimated. It equips banks to handle large volumes of data, particularly relevant in the increasing prevalence of digital transactions and customer interactions.

Furthermore, GAI has the potential to streamline various operations, including evaluating loan requests and implementing anti-fraud measures, resulting in reduced processing times and improved operational efficiency for financial institutions.